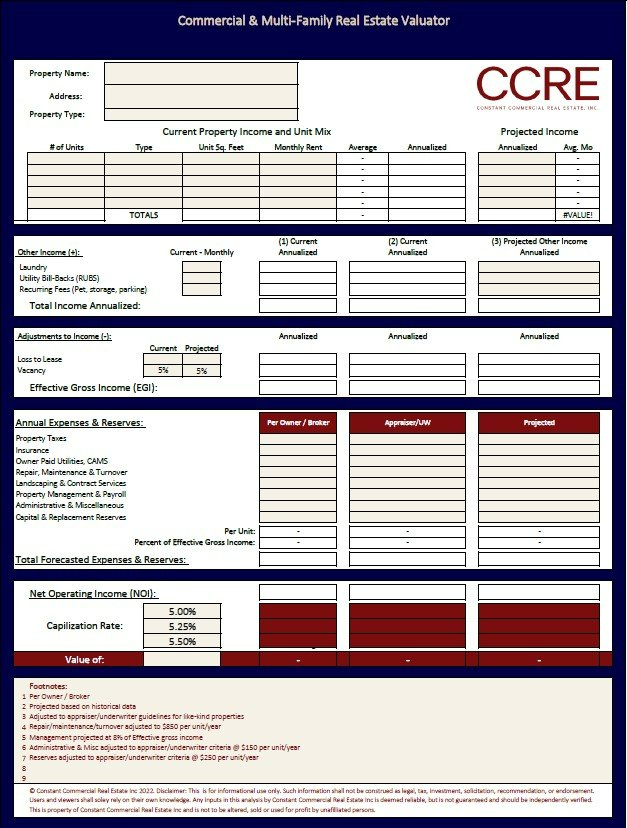

Here is an empty Real Estate Valuation analysis. The template requires inputs in the tan cells and features options to change the operating expenses to reflect the income and expenses being underwritten. For example, the left column may be the years financials annualized, middle is adjusted to the advisor/appraiser/underwriters criteria and the right projected following asset stabilization.

March 11, 2023

Introduction to CCRE's Proprietary Analysis used for Underwriting

Constant Commercial Real Estate takes an analytical and calculated approach to investment real estate underwriting. We believe in adhering to investment fundamentals and looking beyond the surface level of an opportunity by taking a deep dive into the numbers. Our clients get an under the hood view of our process. In this article we will outline the CCRE’s client experience by illustrating the technology and commonly used proprietary analysis tools to underwrite income producing real estate.

As a CCRE client you will share access with our Advisors to a Google Team Drive where all documents from our engagement will be stored. The Team Drives file structure is usually split into the different engagements types we have. This can include Commercial Financing, Property Underwriting (currently owned or acquisitions), listing documents and transactions files. This file structure allows security of private files (like tax returns) and other members of an investment team limited access. The Team Drive also allows live-time analysis updating and property forecasting. Clients can comment their questions or suggestions and we can work together in a collaborative way.

Each analyzed property will get its own folder containing the due diligence documents available to the broker. This usually includes a current rent roll, offering memorandum, profit and loss statements, photos and our proprietary analysis tools.

For each property CCRE underwrites, we provide two proprietary analysis tools. First we start with the Real Estate Valuator (REV) to determine a range of value for the investment using the income approach. The second analysis is the Property Analysis and Return Projections (PARP) to determine yield and model the performance of the investment adding the variability of debt.

- Real Estate Valuator (REV): This tool uses the income approach to determine the current value of an investment. The income approach is one of the three valuation methods and allows investors to estimate the value based on the income the property generates. The income approach is a function of the properties income minus the operating expenses to determine the net operating income (NOI). A capitalization rate is applied to the NOI. Capitalization rates are determined based on comparable sales of similar like-kind properties. For example, 10-20 unit buildings in B neighborhoods built in the 1970’s may have a current market capitalization rate of 6%. CAP rates are a metric used before/excluding debt. Determining capitalization rates requires access to data, experience and should be assessed by a professional. Example: Subject property earns $120,000 in annual income. Total annual expenses excluding debt is $42,000. This provides the Net Operating Income (NOI) of $78,000. Properties similar to this example sell at CAP rates near 6%. Net Operating Income of $78,000 with a 6% Capitalization rate equals a property value of $1,300,000 ($78,(503)222-0282 = $1,300,000).

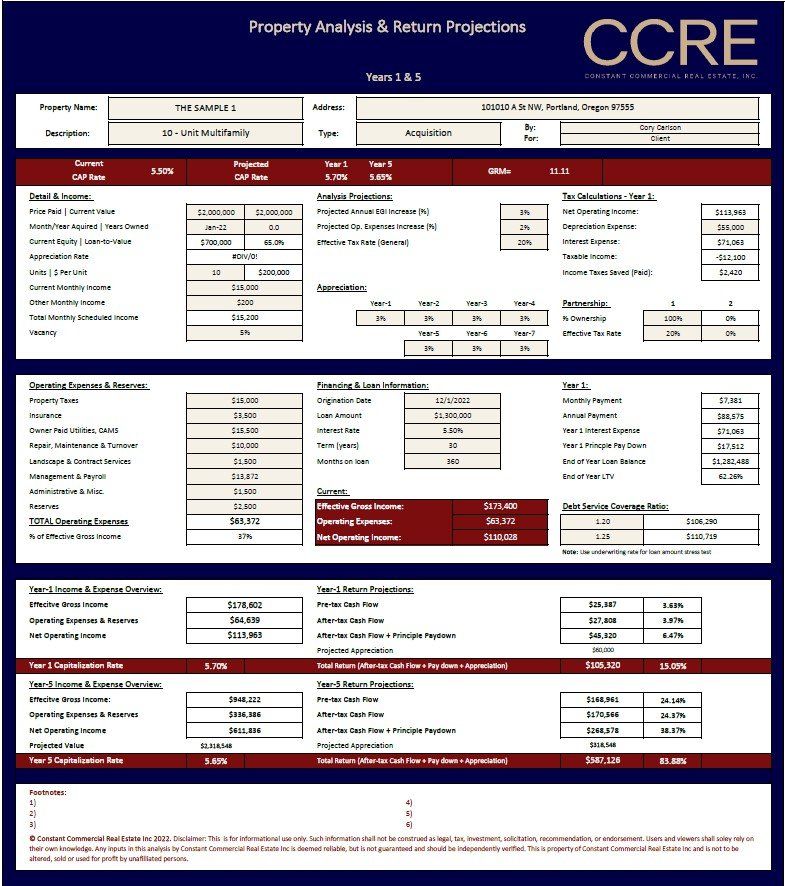

- Property Analysis and Return Projections (PARP): This analysis inputs include income, expenses and factors the variability of debt in years 1, 3, 5 and 7. It takes into consideration principal pay down, tax effects (depreciation, interest expense and investors effective tax rate), annual increases in income & expenses and returns on hte invested capital/equity. This analysis has several utilities allowing the advisor to underwrite prospective acquisitions, currently owned properties and modeling projected returns following a refinance. Many of the major return metrics analyzed are:

- Pre-tax Cash Flow

- After-tax Cash Flow

- After-tax Cash Flow + Principal Pay Down

- After-tax Cash Flow + Principal Pay Down + Appreciation-x% = Total Return

- Capitalization rate, Gross Rent Multiplier and Debt Calculations for proceeding Years 3, 5 & 7

The underwriting process is more of an art than an exact science. Advisors must draw conclusions on adjusting income and expenses from marketing material and provided operating statements. Marketing material often generalizes and could overstate income and make light of the expense load. For buildings with upside and requiring turns, operating expenses may run higher than the provided operating statements. Properties that recently underwent large capital expenditures that are deflating the profit and loss statements in the short term must be adjusted to realize an actual expense load reflected during the hold period. Each property tells its own story and while underwriting may be maneuverable based on the investors goals and capabilities.

Constant Commercial Real Estate Inc takes pride in advising on your investment real estate journey. By taking a conservative approach to underwriting, keeping financing front of mind and staying involved between the buy/sell moment we are your trusted investment real estate specialists.

This 10-Unit Property Analysis & Return Projections (PARP) requires inputs in the tan cells. Generally the middle column "appraiser/underwriter" criteria is translated from the REV analysis featuring a more realistic expense load. The PARP has the ability to forecast and model the properties hold period for new aquisitions and currently owned properties. For current held properties it can calculate the principal pay down from the loans origination which can be adjusted to reflect a refinance scenario.