Services

Real Estate Brokerage | Commercial & Multifamily Financing | Portfolio Management & Consulting

Constant Commercial Real Estate Inc is a versatile multi-service investment real estate firm. A brokerage that handles your real estate sales, financing and strategic advising. Working with investors is what we do.

Real Estate Brokerage - Sales & Leasing

Buyer & Listing Agent Representation

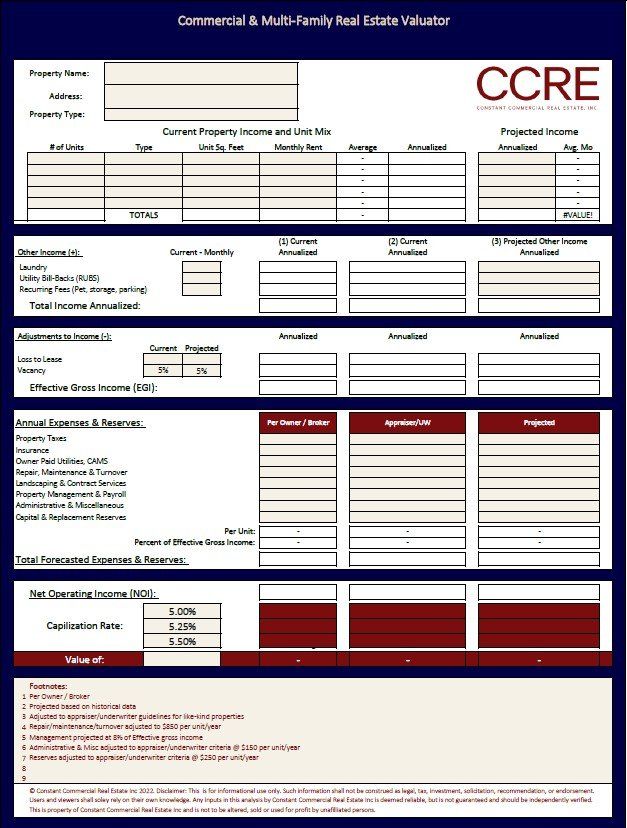

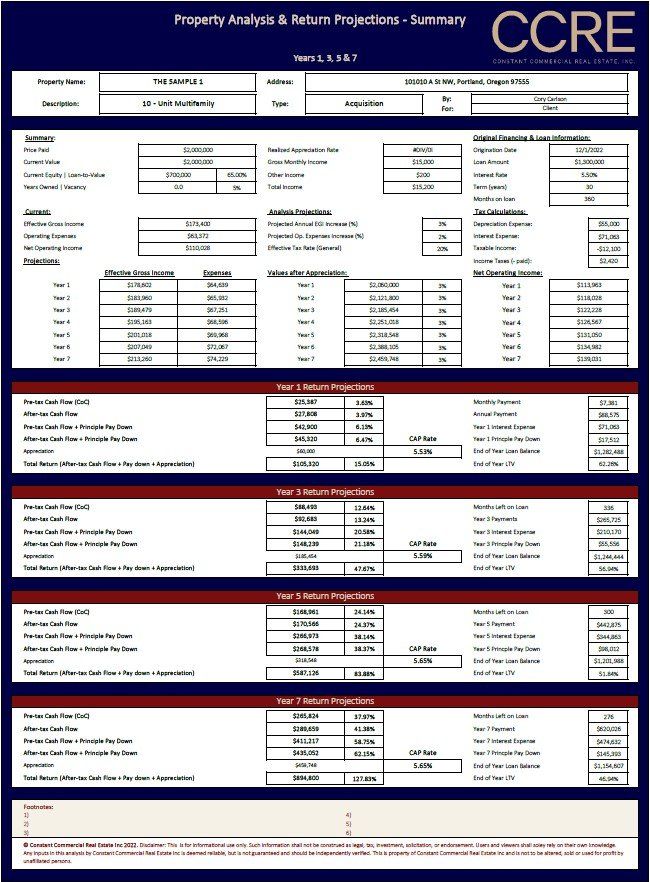

A buyers agent serves as a capital placement specialist with expertise in income-property analysis, financing, and negotiation. Our process begins with a strategic consultation to understand your financing options, investment goals, and overall strategy. We provide realistic yield projections based on actual opportunities, utilizing our proprietary analysis.

Successfully marketing income-producing real estate requires a tailored listing strategy designed to maximize exposure and attract a diverse range of investors. With deep expertise in strategic positioning and financial analysis, we help clients achieve their objectives—whether cashing out, reallocating capital, or leveraging a 1031 exchange or other tax-advantaged disposition strategies. We have a long track record of selling all asset types in our Oregon market ranging from land, single family, commercial property and apartments.

Leasing Agent Representation

Our commercial real estate firm excels in navigating the dynamic market to achieve optimal outcomes for both landlords and tenants. Our leasing agents possess unparalleled expertise in tenant representation, meticulously analyzing specific business needs, conducting thorough market research to identify ideal locations and favorable terms, and skillfully negotiating leases that align with long-term strategic goals. For listing representation, we deploy comprehensive, data-driven marketing strategies, leveraging a robust network of local businesses, established industry connections, and digital platforms to ensure maximum exposure for your property. From professional photography and virtual tours to targeted email campaigns and proactive outreach, we actively engage with qualified prospects. Our deep understanding of local market nuances, combined with a commitment to transparent communication and proactive problem-solving, ensures we not only fill vacant spaces efficiently but also secure the best possible tenants, ultimately maximizing your asset's value and minimizing downtime.

Commercial & Apartment Financing

Apartment & Commercial Mortgage Brokerage

Leverage our extensive network of national, regional, and local financing sources to secure the most competitive financing options. We present tailored loan offers from our trusted lenders and provide expert guidance to help you select the solution that best aligns with your goals.

Inquire for Financing

Contact Us

Simple 3 Step Process

STEP 1: Property Financials & Borrower Information

Fill out the

Contact Us

form and we will provide you a link to access a secure folder to upload due diligence documents.

STEP 2: Discuss Goals & Shop Financing Options

We will discuss loan options, process, timelines and additional documents required.

STEP 3: Loan to Close

CCRE works with all parties required to get the loan to closing in a timely fashion.

Resources & Forms

New Paragraph

Portfolio Management & Consulting

We help investors in all stages explore and develop realistic strategies with attainable returns. Return expectations and exit-strategies can be quantified for investors with any strategy considerations.

Buy/Hold Value-add Fix & Flip Short-term Rentals

Forced-Appreciation Exit-Strategies Development

Capital/Equity Management Syndication & Pooled Funds

Portfolio Analysis & Consulting (PAC) Report

A Strategic Real Estate Portfolio Report outlining currently owned property returns and tailored investment strategy.

Portfolio Analysis and Consulting report contains:

1) Introduction to the fundamentals of wealth growth, leverage and the major return metrics. Return metrics include pre-tax, after-tax and debt effects on yield.

2) Quantifying current and projected returns on equity across the portfolio and to identify strategy considerations and opportunities for improvement and repositioning.

3) Strategy considerations are quantified based on the investors goals and current portfolios performance. CCRE will provide a detailed narrative with supporting analysis. Improvement options may illustrate a combination of improving currently held property returns, cash-out refinancing, and dispositions/1031 exchange into higher yielding property types.

4)

Action items and recommendations of associates to complete the advised strategy. Ie. exchange accommodator, CPA, title company, attorney, financing/mortgage professionals, contractors, photographers, etc.